on PointsYeah's website

How to Find Cheaper Last-Minute Flights in 2025

You probably won't find a last-minute deal, but you can avoid paying the highest prices with these strategies.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

These days, last-minute flight deals are incredibly rare — and waiting until the last second to score a cheap ticket could cost you hundreds of dollars.

Once you cross the sweet spot booking window for domestic flights (typically one to three months out) and international flights (usually two to eight months in advance), you're typically watching prices climb, not drop. Airlines know that people booking last-minute often have no choice but to travel, whether it's a family emergency, a business meeting or a trip that just can't be rescheduled.

Here's what you can do about it.

In this article

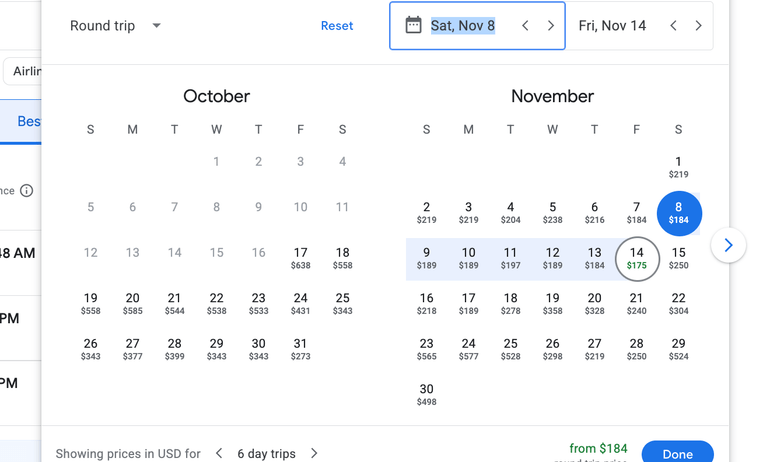

Find the cheapest days to fly on Google flights

Google Flights remains the gold standard for comparing prices across multiple airlines and dates. When you're searching for flights, you might be able to save more by:

Shifting your travel dates. When you click on the dates of a search on Google Flights, you'll see a calendar showing the lowest prices for that route across an entire month for several airlines. See if you can adjust the dates of your trip for more savings.

Tuesday and Wednesday flights are typically cheaper than those on Friday and Saturday. Early morning and late evening flights also tend to be less expensive. (Bonus: early morning flights are less likely to be delayed).

Checking the "Cheapest" tab. These flights might leave at odd hours or come with inconvenient layovers — but if you're looking to save, those are sacrifices you might be willing to make.

Considering alternative airports within driving distance of your destination. Flying into Oakland, California, instead of San Francisco, for example, can sometimes save you serious cash. Just make sure to factor in the cost and time of getting to your final destination.

» Learn more: 5 new ways to maximize your travel booking on Google

Consider two one-way tickets vs. a round-trip ticket

Always compare the cost of two one-way tickets versus a round-trip fare. Typically, for flights within the U.S., you don't save any money by opting out of the round-trip ticket.

Sometimes, one airline offers the cheapest outbound flight, and a separate one offers the cheapest returning flight. By mixing and matching one-way tickets from different airlines, you could reduce your overall cost. For example, you might fly United Airlines out and Delta Air Lines back, or catch a budget carrier one direction and a legacy airline the other.

Use points and miles

Award bookings using points and miles operate in a different universe than cash fares. While cash prices typically skyrocket in those final weeks before departure, points prices often stay relatively stable or increase only modestly.

If you have transferable points from programs like Chase Ultimate Rewards® points, American Express Membership Rewards or Citi ThankYou points, you can move your rewards to one of several airline partners, giving you many more options.

To get a good look at all your options, try an award-booking service like PointsYeah and Point.me, which aggregate award availability across multiple airline loyalty programs. These platforms highlight options you might miss when searching airline websites one by one. Basic searches are free, and you can pay a subscription fee for more advanced search features.

Check package deals

Travel sites like Expedia, Priceline and Kayak occasionally discount the flight portion heavily when you book a package. Even if you don't need the hotel, run the numbers. Especially with last-minute surge pricing, you may find situations where a flight-plus-hotel package costs less than the flight alone.

Check your travel insurance benefits

If you're booking a last-minute flight because of a sudden change in plans — such as a medical event or inclement weather — check your travel insurance policy, if you have one. You might be able to get reimbursed for some costs:

Trip delay coverage can reimburse you for meals and accommodation if your flight gets seriously delayed or canceled and you're stuck overnight.

Trip interruption coverage protects you if you need to cut your trip short for covered reasons.

Even if you didn't purchase coverage, you might still have it if you booked your flight on a premium card. Many premium cards include automatic travel insurance for flights booked on those cards.

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $1 million.

• Rental car insurance: Up to the actual cash value of the car.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

Terms apply.

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to the actual cash value of the car.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: American Express Platinum Card®

Business travelers: Ink Business Preferred® Credit Card

Citi Strata Elite℠ Card

Travel

Dining

Nerds give rare 5-star rating to this new travel card. Get high rewards rates on travel + dining purchases, nearly $1,500 in benefits, valuable transfer partners (including American Airlines). ⏳ For a limited time, earn 100,000 bonus Points after spending $6,000 in the first 3 months of account opening. (Sponsored)